Who has the option to make repayment in Silver Generation?

Members who are 50-59 years old who has signed consent form and opted to defer conversion to SPK until TAP 55 Years Old is withdrawn 100%.

Why does a deferred Member has the option to make repayment?

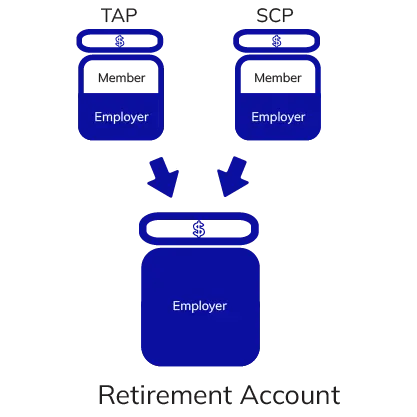

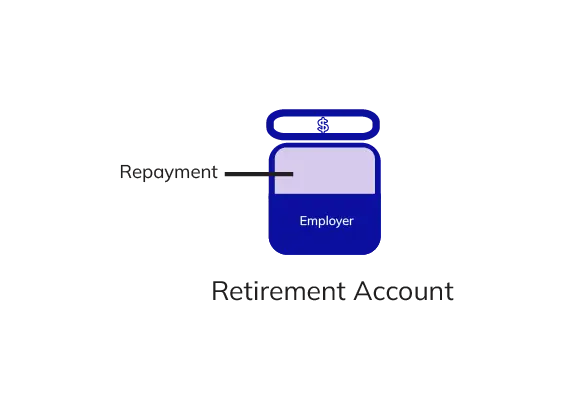

Retirement Account in SPK consists of Employer's contribution.

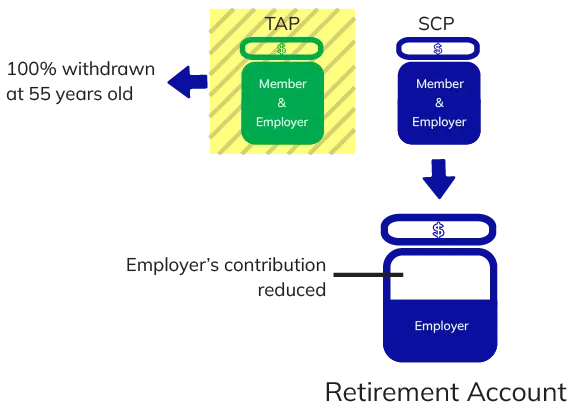

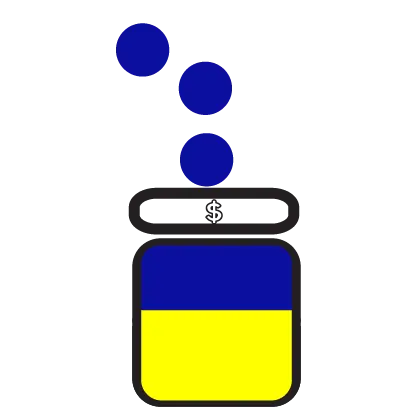

Deferred conversion to SPK allows Member to withdraw 100% of the TAP account balance at age 55.

At 100% withdrawal, Member will also take out the Employer’s portion in which will reduce the Employer’s contribution in the SPK Retirement Account during the conversion to SPK - only balance in SCP account goes into SPK Retirement Account once the balance in TAP Account is withdrawn.

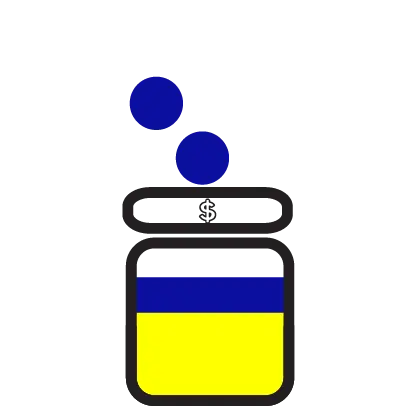

Reduced Employer's contribution in SPK Retirement Account will also reduce the SPK Annuity (monthly) for Member's retirement.

Member can make repayment to recover the reduced Employer's portion in order to increase the SPK Annuity (monthly) for retirement.

Type of Repayment

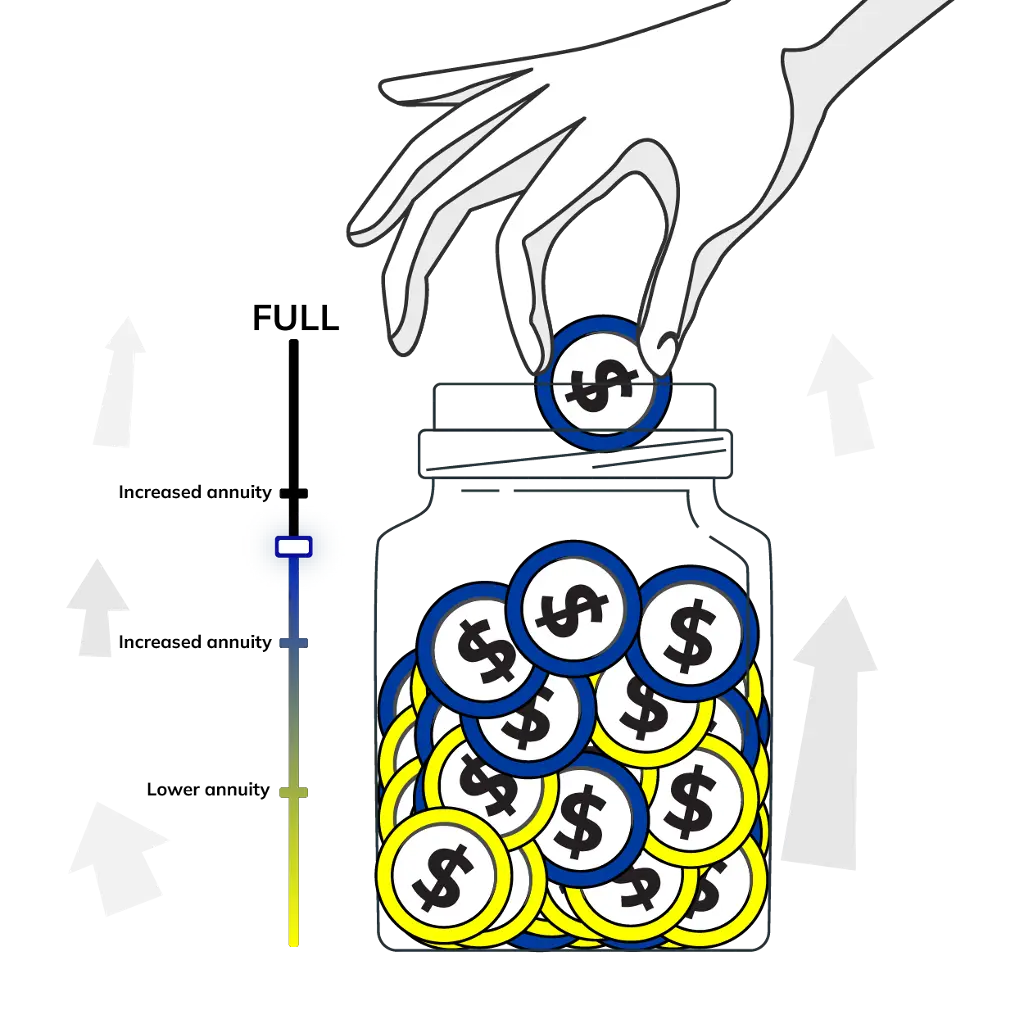

Full repayment

Member can make full repayment of the Employer’s portion to receive FULL SPK Annuity.

Partial repayment

Member can make partial repayment of the Employer’s portion (any amount) to INCREASE SPK Annuity (annuity is higher than no repayment at all).

No Repayment

Member can opt to not make repayment of the Employer’s portion and the member will receive a REDUCED SPK Annuity.

Things about repayment that you need to know

Repayment can be made latest ONE (1) month before Member turns 60 years old.

Repayment can only be made ONCE into the SPK Retirement Account.

Member can use the following method to make the repayment into the Retirement Account:

Immediate repayment at TAP 55 years old application.

Member can state the amount of repayment for Employer’s portion (full or partial) in the application form when withdrawing TAP 55 years old. TAP will automatically deduct the stated repayment amount from the balance and the remaining amount of the TAP balance will be transferred into Member’s bank account.